It’s only Wednesday, and two more in-your-face transactions by public company management teams are added to the pile. More on MPW 0.00%↑ and PRPL 0.00%↑ below.

These are small relative to the major bank robbery over at BBBY 0.00%↑ , where Ryan Cohen (of GME 0.00%↑ fame) bought up amost 10% of the company shares to help “turn around” the company.

His abrupt exit in August was the crazy bit. He announced that he had purchased large numbers of call options with strike prices between $60 and $80 with the shares at $20. This was catnip for retail traders who piled into the stock, sending it up 200-300%. Cohen unloaded his entire position into the retail demand and then announced he was out.

“Pump and dump” schemes have been around for a long time, but the scale of this one is hard to match. Cohen did this with 9.45M shares of stock and options on another 1.6M shares. He unloaded his entire position at prices in the $20’s leaving individual investors holding the bag with the shares back to $8.

Cohen executed the dump as a press release was being drafted and soon released indicating that the company was hiring bankrupcy attorneys to deal with their precarious financial situation.

So Cohen knows the meme stock game better than anyone, had insider information, and made announcements clearly intended to manipulate the share price. Guess that’s all fine now?

The Chief Legal Officer at Purple PRPL 0.00%↑ must be a savant.

This is tiny in terms of scale but it’s a little more special due to the title of the insider. Purple jumped this week on takeout news that emerged immediately after the legal chief made a timely purchase.

Some might say it’s just a small purchase but the SEC law is not based on the size of the transaction.

If this individual changes firms and works for another public company everyone should track their buys and sales carefully. Look at the last sale in January 2021 - top ticked it! It’s rare to see someone this good! I wonder if there is any information advantage there?

There’s nothing illegal making smart purchases as an insider but when your rifle shots are this accurate it’s surprising.

Medical Properties Trust MPW 0.00%↑ Gets U-G-L-Y.

There’s been an “axe” on this name as a short idea this year. For months, Rob Simone has provided a deep dive play-by-play on deceptive management practices.

It’s a little dry because a lot of it is about financials. The oversimplified picture is that MPW is a landlord with broke hospital tenants. But they make loans to the tenant so they can pay the rent.

I’m not into REITs but this is definitely not a winning business model for a REIT. It’s a little like a business with negative gross margins and no scale advantages.

Management at the company works hard to keep investors from viewing the company this way to the point of being combative. Analysts still have positive ratings on the stock because it appears cheap with a 6 P/E and close to a 9% dividend yield. (Emphasis added.)

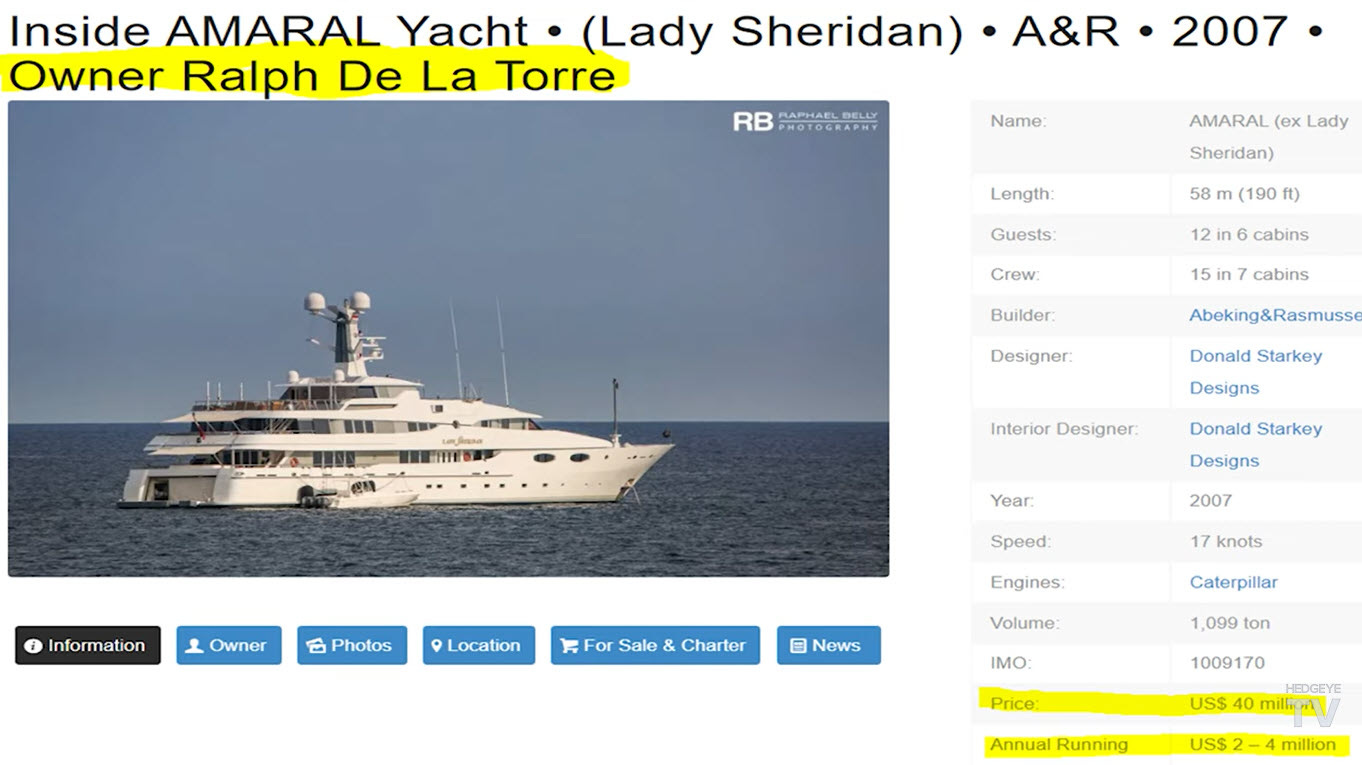

There’s nothing like a $40M yacht to draw attention where it might not be desired. Owner Ralph De La Torre is the CEO of Steward Healthcare (the major tenant and loan recipient from MPW.)

Maybe it’s because these are hospitals that make it seem just a little more gross than usual. Mr. De La Torre sure isn’t putting the “community” in the Community Healthcare that Steward is responsible to provide.

Rob has a five-minute video on YouTube about it.

BTW on SEC

Securities law works differently than the “Law and Order” style most people are familiar with. The burden of proof is on the defendant.

If you are on the senior management team, board member, or another insider, it’s highly unlikely that you don’t have any information. I’m sure Cohen knew about the dire situation at BBBY, then intentionally manipulated the stock and exited.

Smaller transactions like the Purple example are usually handled with a small fine and a return of any gains believed to be ill-gotten.

So what exactly are the priorities at the SEC? Are we doing some kind of low-level legalization of securities fraud because it’s just too hard to catch it all? Kind of like police not arresting people for small amounts of drug possession?

The Granddaddy of Insider Trading

Congress members have been doing insider trading for decades. It’s hard to take the law seriously when the United States Congress is doing it! Some major stories have hit mainstream media, but it’s just the tip of the iceberg.

It’s not just a US phenomenon. In 2012 the Swiss National Bank Chairman, Philipp Hildebrand, resigned because he could not prove that he didn’t know about the currency trades his wife was doing in front of official announcements. At least he had the decency to resign and note that he “wanted to protect the integrity of the central bank.”

It’s gotten so bad that there is a new law being worked on to ban stock trading by members of Congress. Maybe if it happens, they will get jealous of others doing insider trading and start to crack down on it elsewhere.

Stay Clean Anyway

Even though lots of people seem to be on the take and no enforcement is happening, it’s better to stick to the high road.

What’s odd is that legal and compliance are taken very seriously in the securities industry. I’m no longer in it, but the training gets ingrained to avoid even gray areas carefully. Management is not licensed by the SEC and doesn’t go through that same level of training. Maybe they should be.

Remember that securities law works differently, so it’s best not even to have the potential to appear to be trading on insider information. For example, don't trade the stock if you have a family member working at a public company.

Our investment working groups are careful not to share any information that might be judged sensitive. Why? Because if you are already buying something based on your research and someone tells you something that’s insider information, you are at risk. It’s a situation that you don’t want to be in.